Oman Country Risk Analysis (1993–2021)

Author: Abdolreza Iesvand Heidari,

Date: Nov 08, 2024(review)

Country Risk Analysis of Oman: 1993–2021

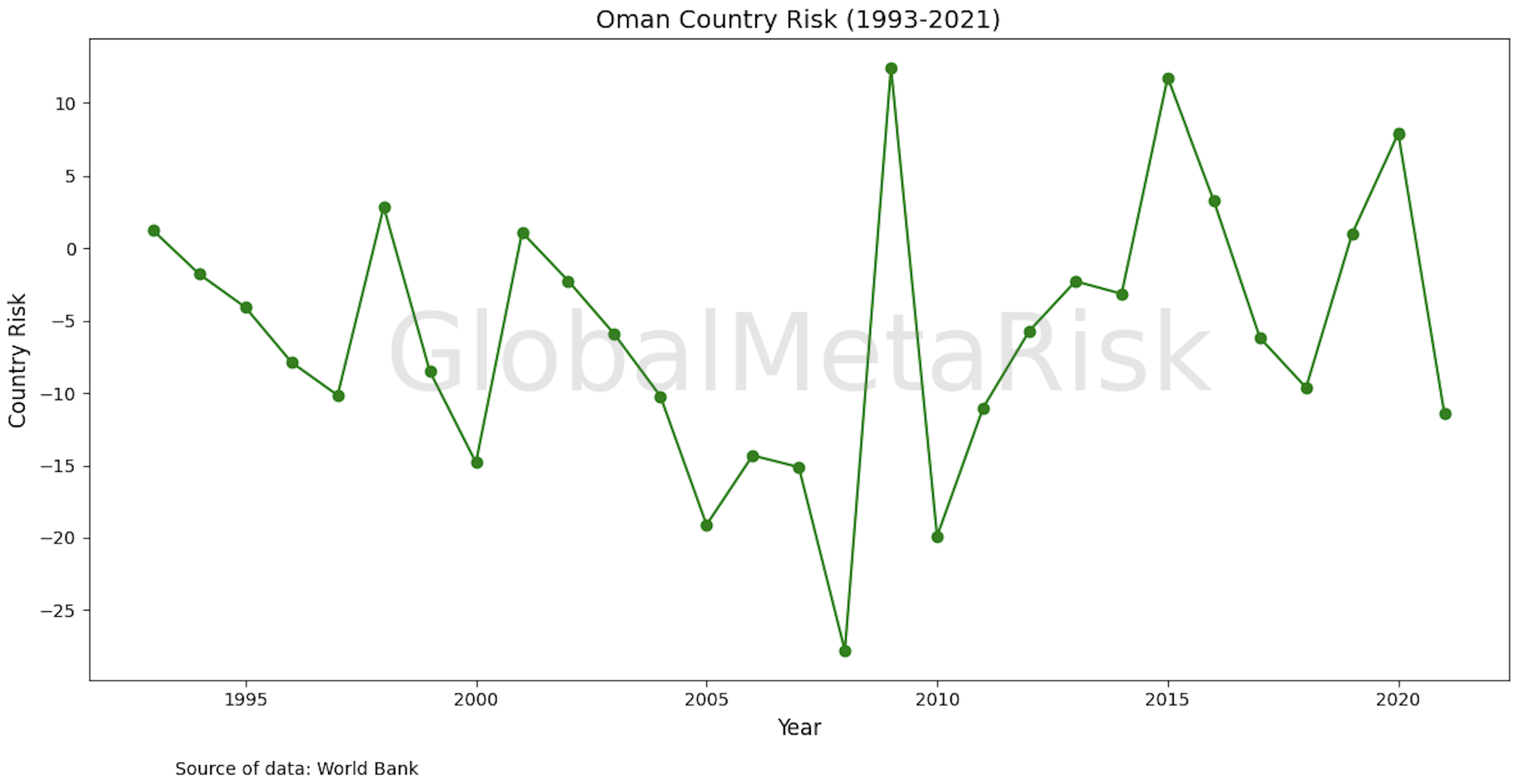

Oman, a country strategically located in the Middle East, has experienced fluctuating country risk levels from 1993 to 2021. This analysis, conducted by Global MetaRisk, examines the country’s evolving risk profile based on annual data from multiple macroeconomic variables. The provided risk chart reveals how Oman’s country risk has been influenced by both global economic crises and domestic economic strategies, shedding light on the key factors that have shaped its risk landscape over the years.

In the early years of the study (1993–1999), Oman’s country risk remained relatively low, with fluctuations mostly within stable or slightly negative levels. This period coincided with a time of internal political stability under Sultan Qaboos, who focused on maintaining peace and pursuing gradual economic reforms. However, there were notable dips in 1998 and 1999, possibly due to regional economic challenges, including the Asian financial crisis and its ripple effects on the Middle East.

The most significant rise in country risk occurred during the 2007–2008 global financial crisis. As shown in the risk data, Oman’s country risk sharply increased to -27.80 in 2008, reflecting the global economic downturn and its direct impact on oil prices. As an oil-dependent economy, Oman was severely affected by the collapse of oil prices during the financial crisis, leading to budget deficits, a slowdown in external investments, and a contraction in key economic sectors. The country’s vulnerability to oil price fluctuations was a key driver of the risk surge during this period.

Following the global financial crisis, Oman’s risk level showed signs of recovery. In 2009, the country risk indicator jumped to 12.42, reflecting the rebound of global oil prices and a recovery in international trade. However, the risk remained volatile in the following years, with fluctuations ranging from -19.90 in 2010 to -5.71 in 2012. These variations can be attributed to global and regional factors, including slow global economic recovery, continuing volatility in oil prices, and domestic challenges in managing fiscal balances.

From 2017 to 2019, Oman continued to face fluctuations in its country risk. In 2017, the risk dropped to -6.19, and in 2018, it worsened to -9.63. These fluctuations reflect continued economic challenges, such as the slow pace of diversification efforts away from oil and continued vulnerability to external economic pressures. Despite efforts to implement economic reforms, including fiscal adjustments and expanding non-oil sectors like tourism and manufacturing, Oman’s dependence on oil exports continued to expose the economy to external shocks.

The most significant external shock in recent years has been the COVID-19 pandemic, which began affecting the global economy in early 2019 and intensified through 2020. As reflected in the risk data, Oman’s country risk sharply increased during the pandemic, peaking at 7.94 in 2020. This jump in risk corresponds to the global economic slowdown caused by lockdowns, a reduction in global oil demand, and the negative impacts on the country’s public health system and domestic economy. The pandemic’s effects were compounded by a sharp drop in oil prices in 2020, and Oman, like many oil-exporting nations, faced significant fiscal challenges. By 2021, Oman’s risk level had decreased slightly to -11.44, but it remained high due to ongoing economic pressures, slow recovery, and challenges in managing the fallout from the pandemic.

Global MetaRisk, using its sophisticated modeling techniques, has assessed that Oman’s country risk has consistently reflected both its internal economic policies and the external global environment. The key drivers of Oman’s fluctuating country risk levels have been its heavy reliance on oil exports, its vulnerability to global economic crises, and its ongoing efforts at economic diversification. While the country has made progress in managing risk through sound fiscal policies and strategic diversification, the volatility of oil prices and the external economic shocks, particularly the 2007–2008 financial crisis and the 2020–2021 pandemic, have had a lasting impact on the country’s overall risk profile.

In conclusion, Oman’s country risk has experienced significant volatility over the past three decades, with key spikes during major global economic crises, such as the 2008 financial crisis and the COVID-19 pandemic. Despite these challenges, Oman’s political stability and efforts to diversify its economy have helped to maintain its risk at relatively moderate levels compared to other oil-dependent economies in the region. However, as global markets remain unpredictable and Oman’s economy continues its transition away from oil dependence, the country’s risk profile will remain sensitive to both domestic policy decisions and external global economic conditions.